First-Time Buyers Can Now Borrow More!

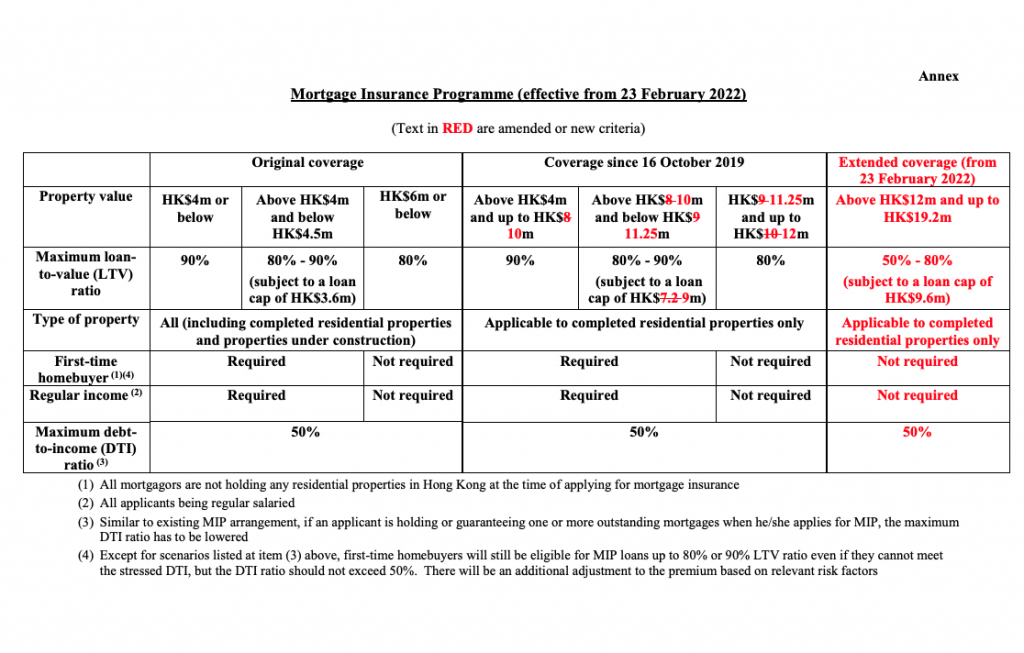

Every cloud has a silver lining. HKMC Insurance Limited (HKMCI), has made the following amendments to the Mortgage Insurance Programme (MIP), in order to provide more assistance to homebuyers with their housing needs!

1. For mortgage loans up to 90% loan-to-value (LTV) ratio applicable to first-time homebuyers (Note 1), the maximum property value is amended to HK$10 million (Note 2);

2. The maximum property value eligible for mortgage loans up to 80% LTV ratio is amended to HK$12 million (Note 2);

3. To avoid a significant drop of the allowable LTV ratio for mortgage loans with property value slightly over HK$12 million, coverage of the MIP is extended to properties valued from above HK$12 million and up to HK$19.2 million, subject to a mortgage loan cap of HK$9.6 million. For example, properties with value of HK$16 million are eligible for mortgage loans with 60% LTV ratio under the extended MIP coverage; and

4. The maximum debt-to-income (DTI) ratio for both the above-mentioned and existing MIP loans is set at 50% (Note 3), and borrowers have to meet the stressed DTI ratio. First-time homebuyers will still be eligible for MIP loans up to 80% or 90% LTV ratio even if they cannot meet the stressed DTI ratio, subject to an additional adjustment to the premium based on relevant risk factors.

Please refer to the Annex for the amendment details. The amendments take immediate effect from 23 February 2022 (Wednesday). HKMC Insurance Limited 23 February 2022 Notes: 1. All mortgagors are not holding any residential properties in Hong Kong at the time of applying for mortgage insurance. 2. The maximum property values eligible for the MIP before its amendments made on 16 October 2019 (i.e. HK$6 million for mortgage loans up to 80% LTV ratio and HK$4 million for mortgage loans up to 90% LTV ratio) remain applicable for all residential properties, including properties under construction. 3. If an applicant is holding or guaranteeing one or more outstanding mortgages when he/she applies for the MIP, the maximum DTI ratio has to be lowered.

Sourced from The Hong Kong Mortgage Corporation Limited.